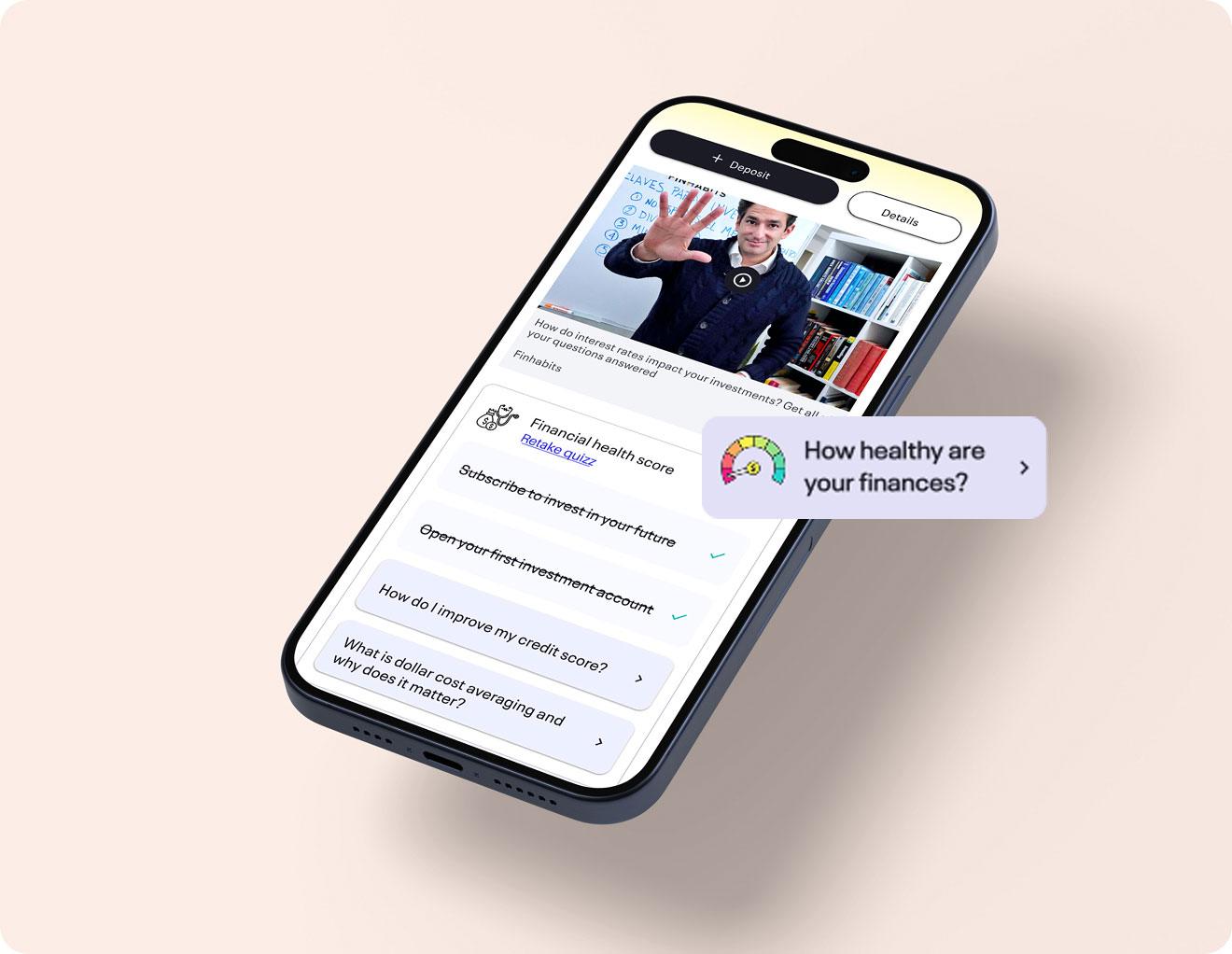

Do you know your Financial Health?

With a few questions, Emma, your your personalized financial planner inside Finhabits can help you understand your financial health score

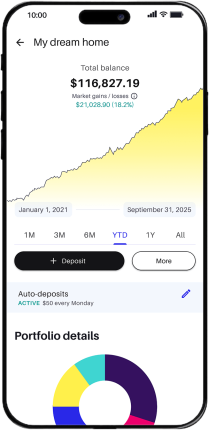

Your best financial future starts today

Invest smartly with a diversified portfolio and the support you need. You don’t have to be an expert—Finhabits does it for you

Build a better relationship with money

Change your relationship with money—one habit at a time. Join the 12-week challenge.

As seen in

Our numbers speak for themselves

Registered users

Audience engagement

App Store rating

Deposits received

At Finhabits we believe

everyone can have a better financial future

Investing made easy

We handle diversification and rebalancing for you across all your accounts - whether your goal is to build a rainy day fund, buy a house, retire, or something else. Finhabits has the account and portfolio you need to make it happen. Open an account in minutes.

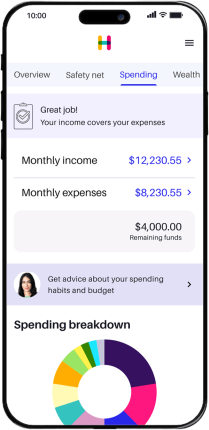

Financial planning so you can reach your goals faster

Schedule a call with a financial planner* or get help 24/7 from your virtual financial planner, Emma. Your better financial future starts with a question– ask it today.

*Available to customers with account balances over $12,000

Protect your financial future

Insurance coverage is an important part of your financial plan because it protects your income, savings, and loved ones from unexpected setbacks that could derail your long-term goals. We help you find only the coverage you need.

We’ve helped over 900,000 people learn better financial habits. Our clients have invested more than $400 million at Finhabits. We’re excited to help you too!

4.6

App Store rating

"Finhabits is a way to grow your money, a way to learn how to invest your money."

Myriam C.

“Go for it, you won’t be disappointed with Finhabits. That would be my message.”

José P.

“You can achieve your goals as long as you start building the habit of saving — the sooner you begin, the more likely you are to reach your objective.”

Olga G.

The testimonials presented are from individuals who were Finhabits users at the time they shared their comments. They were not compensated for their opinions. The experiences described do not necessarily reflect those of all users and are not a guarantee of future results.

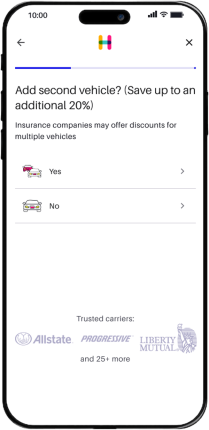

Save on car insurance

Get insurance quotes in one place, compare easily, and choose the best option to protect what matters while taking care of your money

Financial planning so you can reach your goals faster

Schedule a call with a financial planner* or get help 24/7 from your virtual financial planner, Emma. Your better financial future starts with a question - ask it today.

*Available to customers with account balances over $12,000

If you’ve made it this far, it’s because

your future matters to you

Don’t wait any longer—download the app, become a member and start building your financial future.

FAQs

Yes, Finhabits is a registered investment advisor with the U.S. Securities and Exchange Commission (SEC). This registration means they are regulated as an investment advisory firm, ensuring compliance with regulatory standards. However, SEC registration does not imply a particular level of skill or training beyond regulatory requirements.

Yes, you can open an investment account and invest with an ITIN (Individual Taxpayer Identification Number) instead of a Social Security Number (SSN) when using Finhabits.

The Subscription Fee is $10/month. You automatically switch to an annual Asset Management Fee of 1.0% (charged monthly) when the combined balance across all your Finhabits accounts surpasses $12,000. The Asset Management Fee of 1.0% is only assessed on your first $100,000 across all your Finhabits accounts.

At Finhabits, we invest in the U.S. stock market through diversified portfolios that include up to 6 types of assets via Exchange-Traded Funds (ETFs). These assets can include U.S. stocks, international stocks, government bonds, and real estate through REITs (Real Estate Investment Trusts).

Latest stories and blogs

How Much to Invest Monthly for Retirement?

Every month you wait to start investing for retirement costs more than just the money you didn’t save; it costs the decades that money could

Can Investing in 2026 Lower Your 2025 Taxes? The IRA Move That Still Works

Your 2025 tax bill is coming due, and you’re investing new money in 2026. Can these investments actually lower what you owe for last year?

Can an IRA Contribution Reduce Your 2025 Taxes?

Yes, a prior year IRA contribution can reduce your 2025 taxes—even if you make it in 2026. You have until April 15, 2026, to deposit

What Is the True Cost of Early Retirement Withdrawals?

Early retirement withdrawal true cost goes far beyond the 10% additional tax. You may also owe income taxes, may face state taxes, and lose years