The California Secure Choice Retirement Savings Trust Act has legal consequences for non-compliance. Here’s what Latino business owners need to know!

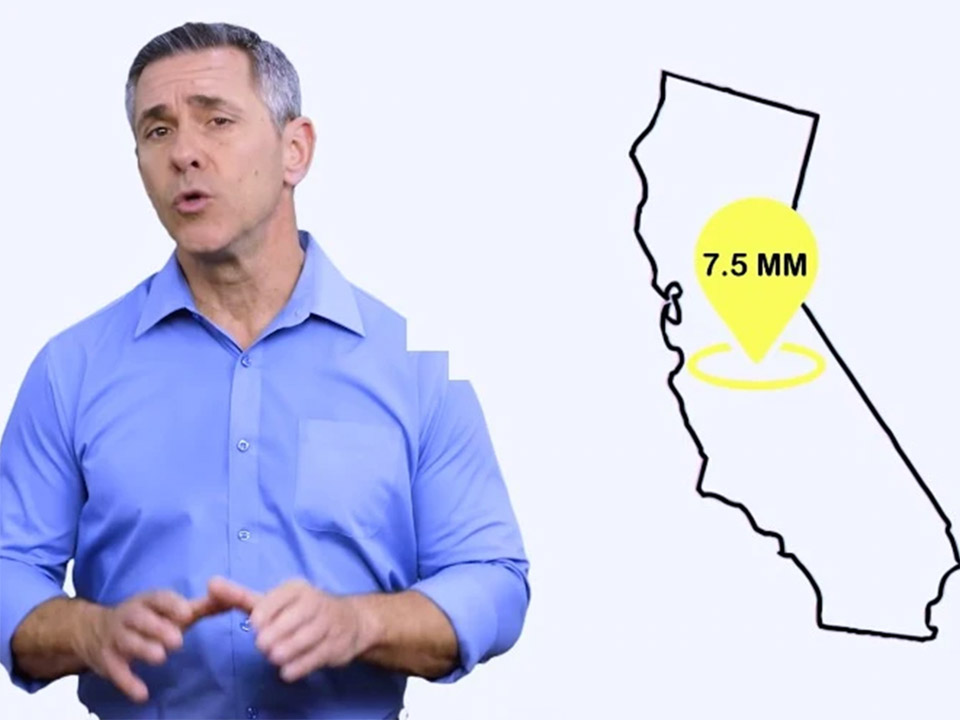

There are almost 800,000 small Latino-owned businesses in California. Many of them will have to offer a retirement savings program for their employees. Otherwise, they will face penalties for non-compliance.

The California Secure Choice Retirement Savings Trust Act requires business owners with one or more employees on payroll to offer a retirement savings program to their employees. Businesses have the option to sign up for a qualified private retirement savings plan or a state-sponsored program.

You can also read: Which Small Businesses Qualify for the California Retirement Program Mandate?

What are the penalties if I don’t comply with CalSavers?

Failing to comply with the California mandate by the deadline could result in penalties for your business. Within 90 days of receiving a notice requiring registration, non-compliant employers could face an initial penalty of $250 per employee. An additional penalty of $500 per employee could be added if an employer has not complied with the law within 180 days of receiving the notice. That’s a total of $750 per employee if you fail to comply with the mandate.

How can Latino-owned California businesses avoid penalties?

If your business needs to comply with the mandate, you must offer a qualified retirement plan to your employees or participate through the state-sponsored program, CalSavers.

Offering your employees a state-sponsored program is not mandatory. Your business has the option of selecting a qualifying private retirement plan like the Finhabits 401k plan.

The plans that Finhabits 401k offers are an easy way to comply with the California mandate. Our plans are accessible for any business, regardless of size, and we offer additional advantages for you and your employees.

How can a Finhabits 401k plan help you?

Latino-owned businesses see their employees as an extension of their families. Finhabits helps your employees learn smart financial habits while they save for retirement. Our app includes educational tools like videos and articles in both English and Spanish.

Additionally, employees who do not have a Social Security number but do have an ITIN (Individual Taxpayer Identification Number) can also participate in the retirement program you provide.

In addition, you, as an employer, also have the opportunity to participate in a Finhabits 401k plan.

To learn more about the Finhabits 401k plans, call 650-265-4010. The Finhabits 401k Team offers support in both English and Spanish.