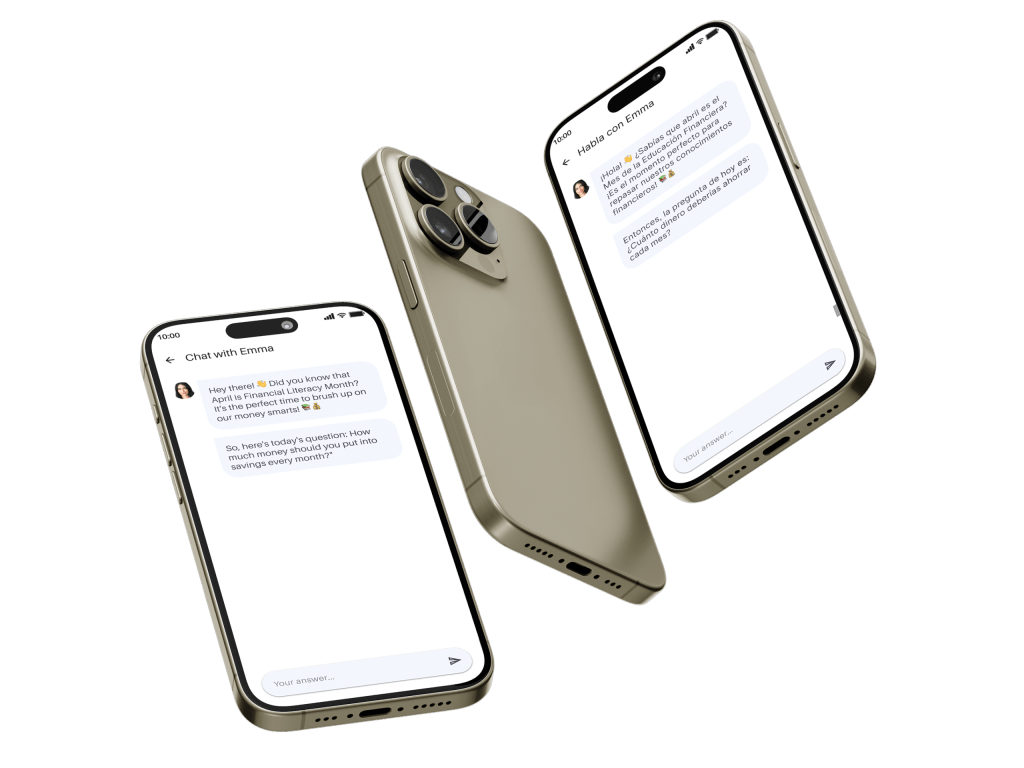

Your better financial future starts with a question

Meet Emma, your personalized financial planner, in your Finhabits App*.

*Included in the Finhabits membership

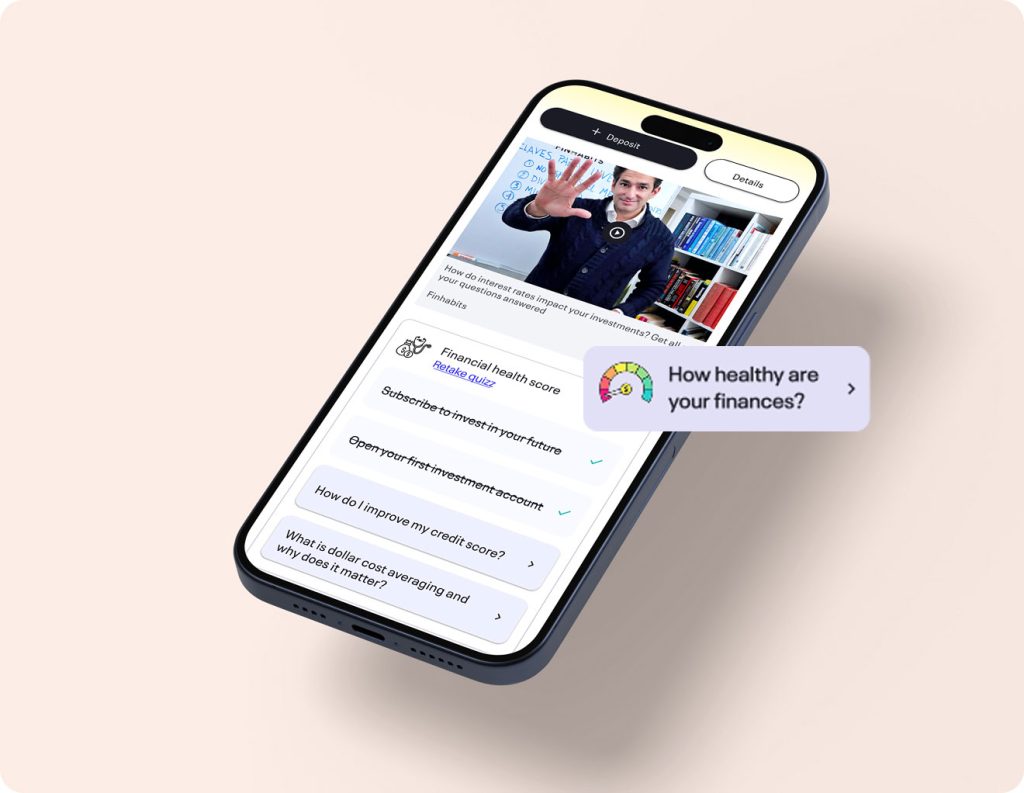

Do you know your Financial Health?

With a few questions, Emma can help you understand your financial health score

Money Journeys

Better Financial Habits

Build confidence with your money, step by step.

On Your Time

Access anytime, anywhere.

Bite-sized content

Short, easy to follow financial education.

Financial planning at your fingertips

Plan, save, and invest with confidence.

Emma guides you step by step.

Financial planning 24/7/365

Emma has answers in your app, whenever you need them.

Finances don’t have to be complicated.

Open the Finhabits app—Emma is available 24/7 to answer your questions, from how to budget and manage debt to how to start investing.

Your better financial future starts with a question. Ask it today—Emma is ready to help.