What can 90,000 Hispanic savers and investors teach us? A lot!

Our inaugural deep dive into Hispanics’ growing wealth and investing behaviors explains why financial institutions need to cater to this population for their own long-term growth.

Tapping into Hispanics’ Power in Numbers

Financial institutions must prioritize serving Hispanics as they shape banking and investment strategies. This is no longer an edge case or ESG initiative; it’s essential for broadening access to wealth-building opportunities in America.

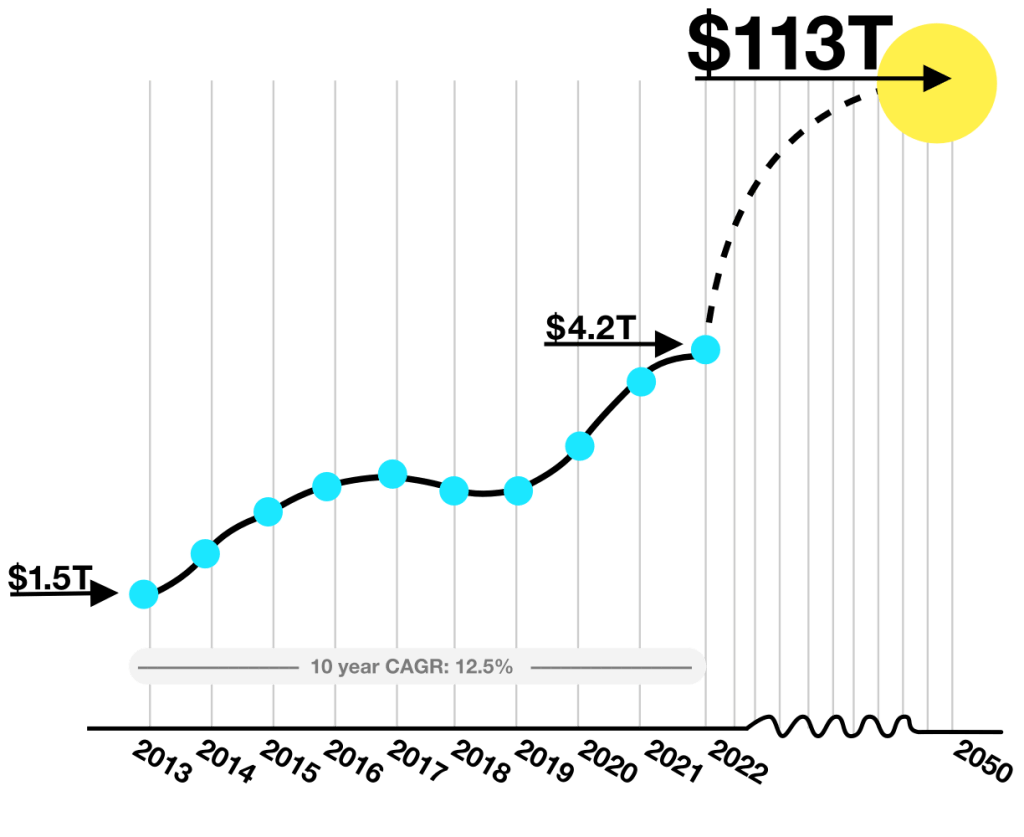

U.S. Latinos are on track to accumulate $113 trillion dollars of wealth by 2050.

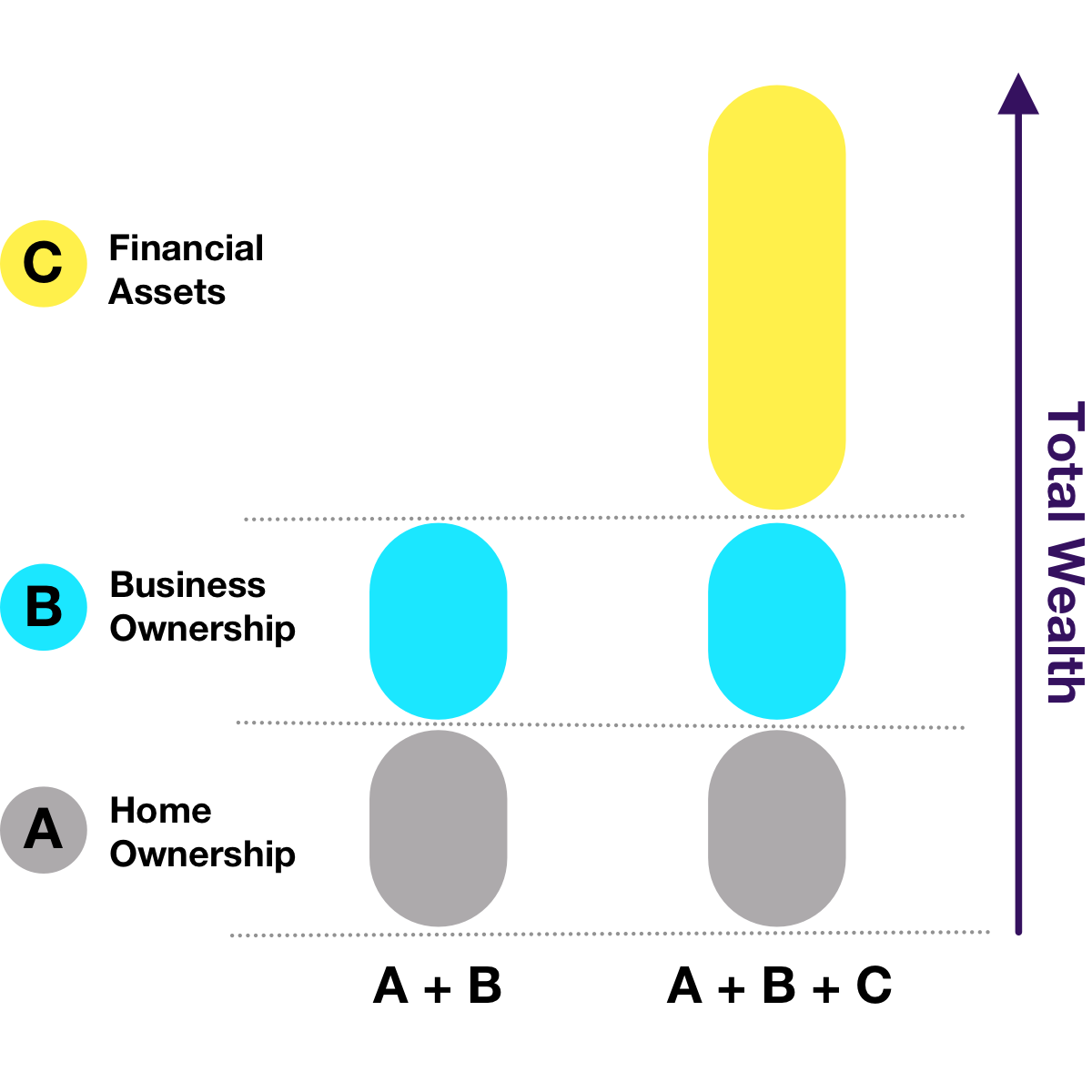

To maximize wealth potential, Latinos must invest in public market securities, not just homes and businesses.

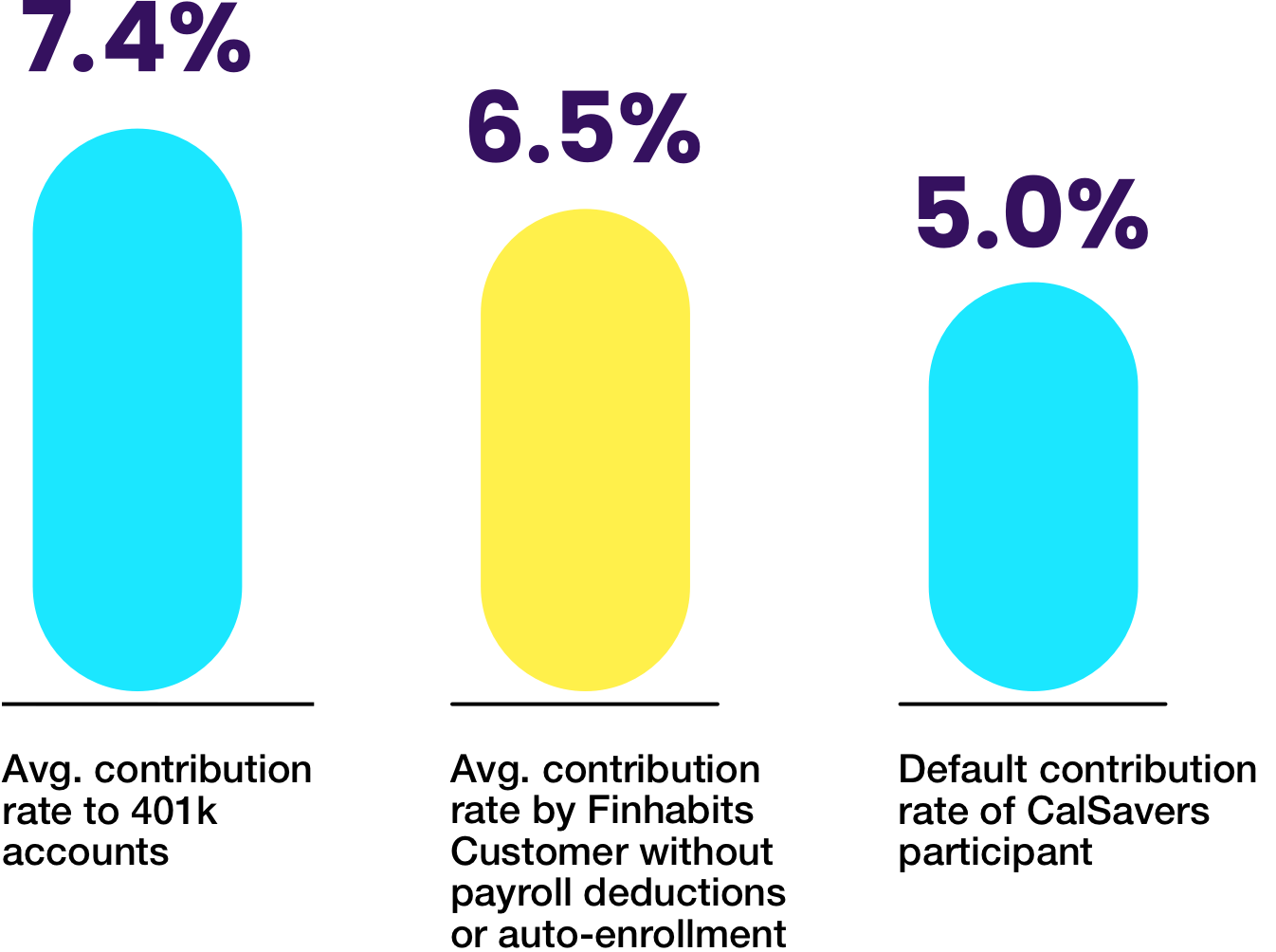

Micro-investments are enabling Hispanics to save 6.5% of their income.

Arriving at this year’s report: Our methodology.

We analyzed the financial investment behaviors of 90,000 Finhabits customers contributing to Hispanic wealth. This, along with census data, highlights trends in retirement, savings, home ownership, and Hispanic-owned businesses.

413 W 14th St #200, New York, NY 10014