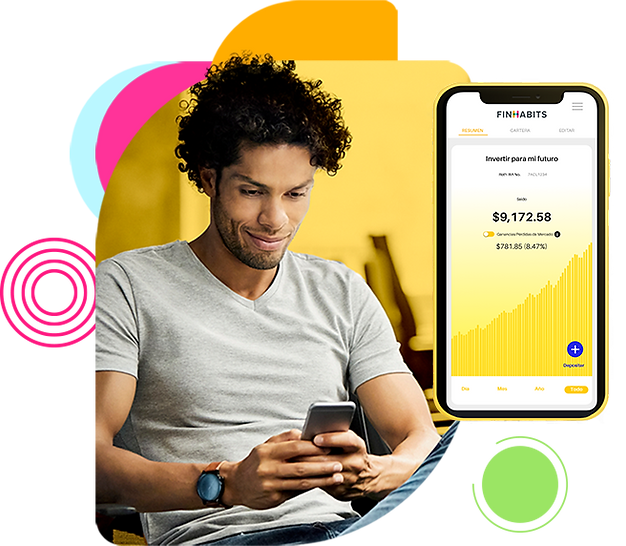

Invest with confidence

and strategy

Finhabits uses exchange-traded funds (ETFs). These invest in hundreds of companies like Tesla, Amazon, and Disney.

Finhabits diversify your portfolio investing in ETFs that include:

– U.S. stocks

– International stocks

– Government bonds

– Corporate bonds

Finhabits is an investment service based in New York City and registered with the Securities and Exchange Commission (SEC), the regulatory agency for investment services in the United States and Puerto Rico. Registration does not imply a certain level of skill or training.

Finhabits invests in the stock market via portfolios that include a mix of up to six types of assets, such as U.S. and international stocks, government and corporate bonds, and real estate investment trusts (REITs), all accessed through Exchange-Traded Funds (ETFs).

Yes. Finhabits allows you to open an investment account with an ITIN (Individual Taxpayer Identification Number) provided by the IRS.

Yes. At Finhabits, we understand the importance of accessibility to your funds. You have the freedom to make withdrawals from your account whenever you need to through our mobile app or website. Please be aware that withdrawals may take up to 5 business days to be processed. We encourage you to approach investing with a longer-term perspective, ideally holding your investments for a period of at least 3 to 5 years.