Your next-level financial superpower is saving a buffer for unexpected situations

Unless you happen to be one of Marvel’s Avengers, you definitely need emergency savings. Why? Because 40% of Americans don’t have enough cash on hand to cover an unexpected $400 expense. Not only can an emergency reserve help you prepare for the unexpected, it can also help you successfully overcome financial hurdles.

Overcome financial hurdles

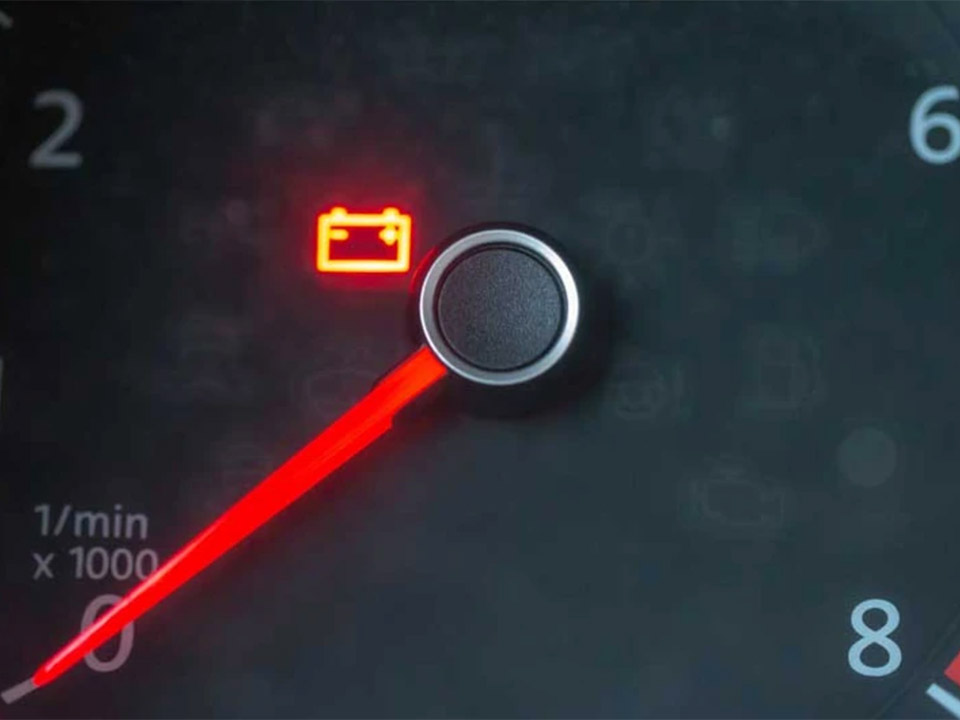

Remember the last time you ran into a financial emergency? You couldn’t just snap your fingers and make it go away. Maybe you had to ask your folks for help. Or perhaps you had to charge the expense to that high-interest credit card or ask the bank for a loan. None of those options are great. They cause a ripple effect that results in further setbacks. If you’ve been saving for your dream car or vacation, when you use those savings, the dream gets pushed farther and farther away. Having an emergency fund is a much better option.

Get started in a flash

You don’t need much to get started with an emergency reserve. First, start with small weekly contributions. For example, you could save that $20 you spent last week on matcha lattes. In one year’s time, putting $20 a week aside could get you to your initial $1,000. Yes, it’s that simple.

Why do we recommend setting an initial goal of $1,000? That way, if you have an emergency hospital visit, a trip to visit a sick parent or unforeseen car repairs, you’re better prepared. Once you’ve achieved that first milestone, you can then move on to your next goal. For example, you could set up at least three months of living expenses you can fall back on if needed.

Set up your savings for success

You should also know where to keep your money saved. Don’t hide that cash under the mattress — that’s not a smart habit. Don’t keep that money in a regular savings account — your bank will make money out of it, but only give you a tiny cut. The best option is to put that money in an account that helps you beat inflation.

Look for an investment account that offers you minimal risk and targets a 2% annual yield or return. If you start with $1,000, you could earn $20 annually. That might not sound like much, but over five years, that investment could generate you $100.

Go for it. Set up your emergency reserve today. You’ll worry less about money and have the peace of mind that if an emergency does happen, you’ll be more than ready.

Get the Finhabits app and learn more about how to start your emergency reserve today.

Finhabits is an app that makes investing in your future an easy habit. Put your money to grow over time while you save – it’s all automated, and in just minutes, you can open a personal investment account or an Individual Retirement Account (IRA). It’s that simple and you can start right here.