Build your financial future

Invest wisely, get health insurance, build smart habits and more

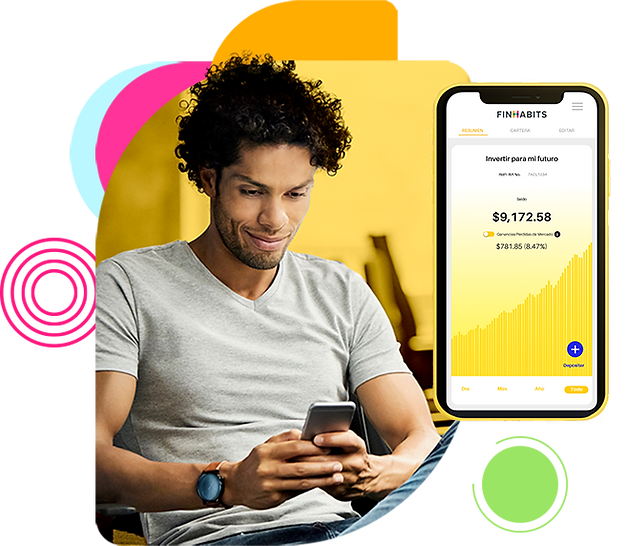

Let’s build smart financial habits

Are you a business owner? Learn about the Finhabits 401k plans here >

$1,000

$10,000

understand what matters most to you

tu idioma

Download the Finhabits app and manage your money in your preferred language

just like you

Thousands of clients

trust us

Yes, you can withdraw money from your Finhabits account whenever you want directly from the app or website. If you have an IRA or 401k, you must check with your tax advisor. Please note it can take up to 6 business days to sell your investments and transfer the money to your bank account. Weekends and bank holidays might delay the process.

Yes, Finhabits is a real company that was founded in 2015 with offices in NYC and El Paso, Texas. We’re are registered with the SEC (Securities and Exchange Commission) the regulating agency of investment services in the United States and Puerto Rico. Registration does not imply a certain level of skill or training.

No, you don’t need a SSN to open a Finhabits account. You can also register using an ITIN (Individual Taxpayer Identification Number).

Finhabits’ subscription is $3 per month for every $7,500 of account balance. The fee covers most of the costs associated with your investment account such as unlimited deposits, withdrawals, re-balancing, and reinvestment of dividends. You could incur extra charges on services that are not part of the normal service such as printed statements.

Invest your money with a real strategy

Take the first step today. ¡Sin compromisos!